There, search for the platform section and the hyperlink to download the MT4 platform. If you have an interest in buying and selling on either the MetaTrader 4 or MetaTrader 5 then there are two account types you presumably can choose from with Eightcap. As explained earlier in this article, the MT4 software program is out there on each mobile and desktop gadgets. However, you may also entry the MT5 straight on to an internet browser which you can’t do on the MT4, as there you need to download the software program onto your desktop. If you’re evaluating which platform between MT5 and MT4 better suits your trading wants, it’s important to assume about their advantages and limitations.

1 Platform Fundamentals

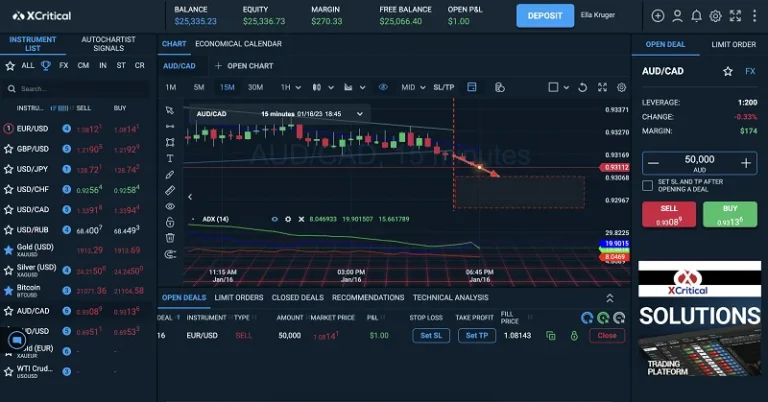

Remember, simply because MetaTrader 5 has extra features doesn’t mean that it is better than MetaTrader 4. Before choosing any type of MetaTrader, you want to research the broker you want to trade with after which compare the variations between MetaTrader 4 and 5. MT5 also has a built-in economic calendar which improves the performance of global financial information on the MT5 platform. One of the principle advantages of the MT5 system is the built-in features, allowing users to seek advice from other merchants.

Orders can be edited when it comes to price levels, however to modify the amount, it is necessary to delete the order and place a new one with the specified quantity. World and Middle East enterprise and financial information, Stocks, Currencies, Market Data, Research, Weather and other knowledge. MetaTrader four and MetaTrader 5 are extra related than different from one another.

What Are The Principle Variations Between Metatrader 4 (mt And Metatrader 5 (mt ?

Though MT4 and MT5 look nearly what is the difference between metatrader 4 and metatrader 5 equivalent on the floor, there are some notable variations between the 2 buying and selling platform versions. That said, either platform could be suitable if you are a newbie foreign exchange dealer. MetaTrader 4, generally generally known as MT4, is a globally recognised trading platform that permits users to view price charts and work together with them in a simple method. It is a robust device for technical analysis and trading in financial markets, significantly in foreign exchange.

MetaTrader four (MT4) and MetaTrader 5 (MT5) are both popular buying and selling platforms within the Forex and CFD markets. While they share similarities, additionally they have several key variations that may influence traders’ determination on which platform to choose. Another important side of any buying and selling platform is the asset lessons it offers.

Learn which platform fits your buying and selling needs best, with insights on options, velocity, and safety. Access TradingView’s charts, real-time information, and tools, multi functional Yield Farming platform. After being released in 2010, MT5 gained fast traction from traders as a end result of its various vary of assets and spectrum of options. At ForexBrokers.com, our on-line dealer critiques are based mostly on our collected quantitative information as well as the observations and certified opinions of our expert researchers. Each 12 months we publish tens of thousands of words of analysis on the top foreign exchange brokers and monitor dozens of worldwide regulator agencies (read extra about how we calculate Trust Score here).

MT5 has a more complex and powerful structure, which permits it to deal with and process orders more precisely and flexibly. You can create a model new MetaTrader 5 account by simply registering for one with us in lower than a minute on the MT5 page obtainable on our web site. You can obtain the MT5 buying and selling platform from there in a few minutes with one click on and launch it in your computer. Hedging is a kind of danger administration technique that permits you to offset any potential losses by opening a place reverse to your current place.

Moreover, in addition they enable merchants to create and import their very own customized indicators, which may enhance their technical analysis. MT5 units the next standard with 38 built-in technical indicators, providing deeper insights into market tendencies and instructions. Traders utilizing MT5 additionally benefit from an unlimited selection of both free and paid customized indicators accessible via its Code Base and Market, tailor-made to classy trading strategies and advanced https://www.xcritical.com/ evaluation.

- They embrace algorithmic buying and selling and expert advisors (EAs), copy trading and social features, and mobile buying and selling.

- One of the main causes for MetaTrader 4’s recognition is its algorithmic trading function.

- They decide the range and availability of buying and selling opportunities for traders.

- Market orders are executed instantly at the current market price, making them ideal for merchants who wish to enter or exit a position at once.

The MetaTrader software program has two variations, MetaTrader four (MT4) and MetaTrader 5 (MT5). To discover the reply and understand which is the suitable alternative for you, follow us on this blog submit. MetaTrader 5 is a step forward with multi-threading servers, additional order varieties, technical evaluation tools, and automatic trading strategies with superior back-testing. MT4 presents 30 technical indicators and 9 timeframes, whereas MT5 boasts 38 technical indicators, 44 analytical objects, and 21 timeframes. While MT4 has sufficient technical instruments, corresponding to MACD, RSI, and Moving Averages, MT5 has additional tools, corresponding to financial calendars, superior EAs, and far more. MQL5 options specialized components of C++ which enable developers to build skilled advisors (EAs), or buying and selling robots, with a larger level of complexity than was possible with MQL4.

Each bar in the chart represents a time interval, similar to a minute, an hour, or a day, and accommodates information about the open, excessive, low, and close prices (OHLC). Overall, the MT4 interface is user-friendly and allows for a significant degree of customization. The primary menu consolidates all commands and capabilities accessible within the consumer terminal. The toolbars replicate instructions from the main menu but may be custom-made to function solely probably the most incessantly used tools. To download MT4, go to the MetaTrader 4 website or the web page of any broker that offers shoppers the option to use MT4.

Find out extra about its intensive range of platforms in my in-depth review of Pepperstone. This MQL5 Expert Advisor (EA) is predicated on Moving Average (MA) indicators combined with a Parabolic SAR trailing cease and optimized position sizing. Place trading orders – remaining or pending orders to sell/buy a substituting tool at a onerous and fast price.

A market order is a dedication to the brokerage firm to buy or promote a security on the present price. No, you can not instantly use the identical indicators and skilled advisors on each MetaTrader four and MetaTrader 5. The programming language used for creating indicators and skilled advisors in MetaTrader four is totally different from the one used in MetaTrader 5. However, you can manually convert or rewrite the code of your indicators and professional advisors to make them appropriate with MetaTrader 5.